This section is in this Report because the author came in contact with the Commissioners when two charitable trusts transferred and sold some school property for the benefit to the trusts. To complete the transactions approval was required from the Commissioners – this approval was forthcoming.

Under the Charitable Donations and Bequests (Ireland) Act 1844 a body corporate known as “The Commissioners of Charitable Donations and Bequests for Ireland” was created………….The purpose of the Commissioners was to ensure “the more effectual application of charitable donations and bequests in Ireland”……………………

The Charities Act 1961 provided that the Commissioners should continue in being and consist of not more than eleven members each of whom should hold office until his death, resignation or removal from office.

For membership of the Commissioners, please see their website at http://www.pobail.ie/en/CharitiesRegulation/CommissionersofCharitableDonationsandBequestsforIreland/

From the Website of the Commissioners of Charitable Donations and Bequests

Objective 1 To contribute to the public good by ensuring the wishes of people making charitable donations are protected……..

Objective 6 To promote equality.

During the year ended 31st December 2008, we (The Commissioners) dealt with 509 applications and sealed 291 orders in respect of matters affecting charities and charity property. We held 12 meetings and an average of 42 items appeared on the agenda at each meeting.

The Commissioners of Charitable Donations and Bequests are appointed by the Government.

Comments:

- The Commissioners for Charitable Donations and Bequests for Ireland (Charity Commissioners) are at the centre of the regulation of Church involvement in the ownership and trusteeship of schools..

- The Commissioners are the State body which controls the ownership of schools (if any State body does), and is important in ensuring that charitable bodies do not breach the trust put in them. The citizens and the State in Ireland entrusted those charities with donations towards the funding of the vast majority of schools in Ireland.

- It is important that charitable bodies which act as Patrons and Trustees in National Schools cannot realistically threaten to remove the schools from the National Schools system. The Charity Commissioners have a pivotal role in ensuring that this does not happen.

- It appears that the bulk of the work of the Commissioners is to take applications from various charitable trusts to sell or move property, and to approve or disapprove such applications.

- The Annual Report of the Charity Commissioners gives no details of the applications and orders sealed.

- The author is aware of three transactions dealt with by the Charity Commissioners, allowing movement or sale of donated property – the average value of these (in todays money) was approximately €6million euro. If this is a reasonable average, the Charity Commissioners may deal with €1,800,000,000 of property per year – €150,000,000 of property at each monthly meeting.

- The Charity Commissioners appear to be very much part-time commissioners – they include individuals with important responsible full time posts outside the Commissioners..

- In none of the cases known to the author is he aware that the Charity Commissioners achieved knowledge as to the wishes of those who made donations for the purchase of the properties involved.

- The public consultation process which might allow for knowledge as to the “wishes of people making charitable donations”, in one case known to the author, consisted of a notice on a parish notice board in a church (the property involved was not the church but rather a local school). None of those objectors to the actions of the Charity became aware of the involvement of the Charity Commissioners until years after the transaction was complete.

- The Annual Report does not detail anything significant about the 500+ applications it processes each year, with a value of perhaps €1.8billion, but reports in some detail about a small investment fund of some €27million which it controls.

- The Commissioners seem to make some effort when given details of Charitable Bequests, but seems to take no account of Charitable Donations. It would seem to the author that the bulk of the schools controlled by Charitable Trusts are funded by local donations, and not by bequests.

- In none of the standard forms of application to the Commissioners is there any request for information as to what charitable donations were made which may have contributed to the property (if the sale of a property is substance of the application) coming onto the possession of the Charity. In two of the cases of which the author is aware, it appears that “the wishes of people making charitable donations” were not protected.

- If the Commissioners do not act according to their main objective, there seems to be no way of stopping charitable trusts using donated funds for the personal welfare of the members of the charitable trusts. It is possible for a charity to receive donations to build a school – to run the school for a number of years getting paid for any work the members do during this time – and to then close and sell the school premises and use the funds for the private use of their own members.

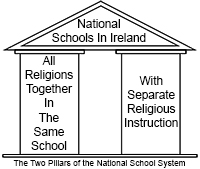

- The illegality of a “Catholics First” admissions policy in a National School cannot be tackled as long as the Catholic Church can treat property donated to it in trust for their own private purposes. National schools, and funds donated for the purchase and maintenance of such schools, must remain as National schools. The Commissioners of Charitable Donations and Bequests must be vigilant in these cases.